|

Date |

Topic |

Overview |

| |

2025-06-06 |

Quantification

|

Forecast manifesto. The academic forecasting literature does not. Practitioners need guidance based on rigour, not on harvesting low hanging fruits. This manifesto demands preregistration of forecast studies for meeting higher academic standards in economic forecasting studies. Support now the «forecast manifesto» Details» |

| |

2025-05-16 |

Quantification

|

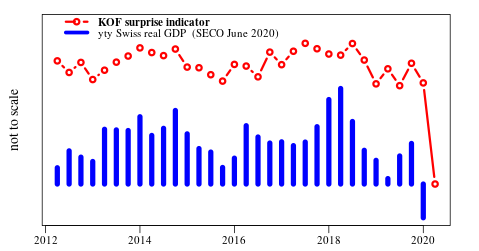

Forecast update. Yet another decrease in the «KOF Surprise Indicator» to -0.057 (down from -0.042) implies that year-on-year growth slides further down to 0.6 percent in the first quarter. Details» |

| |

2025-03-30 |

Fiscal Policy

|

Inheritance tax. No tax does less harm to the economy than the inheritance tax and yet no tax save the poll tax is more contested. Most arguments against it are terribly flawed which is best deal with «Bullshit Bingo» Erbschaftssteuer. In German. Details» |

| |

2025-02-20 |

Quantification

|

Forecast update. A minor fall in the «KOF Surprise Indicator» to -0.044 (down from -0.041) implies that year-on-year growth in 2024 amounts to only 0.5 percent. Details» |

| |

2024-11-16 |

Quantification

|

Forecast update. Swiss economy shines a bright autumn light the recent increase of the «KOF Surprise Indicator» to -0.045 (up from -0.056, revised) implies. The estimated annual growth rate jumps to 3.1 percent, definitely calling off a recession. The year might end with a healthy number north of the zero line instead. Details» |

| |

2024-09-26 |

Uncertainty

|

Podcast. Tune in to the one and only «Uncertainty and Economics» podcast! Thanks to google's notebook LM, Uncertainty and Economics has been turned into a mind-blowing podcast covering (almost) all the key issues in the book in a truly inspiring and entertaining way. What's more, listening to the podcast makes you get a grip even on the otherwise rather hard to digest parts. Two fantastic and nice AI hosts extend their warm welcome! Details» |

| |

2024-08-24 |

Teaching

|

AI teaching revolution. Transform your PDF material in pure text with word-by-word extraction of text and in-depth description of all visual material at QnAI's unique PDF-to-text service. Your results will be the ideal input to QnAI ingenious exam and studying support suite. Details» |

| |

2024-08-16 |

Quantification

|

Forecast update. Despite yet another drop of the «KOF Surprise Indicator» to -0.055 (down from -0.051) a calling a recession has become less likely. Year-on-year growth remains weak at 0.5 percent year-on-year yet the negative territory has been left. Surprisingly optimistic GDP estimates by the Swiss state secretariat for economic affairs seems to be the main driver of this «turnaround » offering a stern warning against undue complacency. Details» |

| |

2024-02-18 |

Teaching

|

AI teaching revolution. Watch this video providing a sneak preview into the future of AI powered teaching and learning. Let AI do the boring

part of creating and putting together tests and exam questions for your students or self-study. Get premium access for taking full advantage of AI powered quizzing today! Details» |

| |

2024-05-16 |

Quantification |

Forecast update. The «KOF Surprise Indicator» slides further to -0.051 (down from -0.041, revised) signaling even weaker performance of Swiss GDP. Year-on-year growth at a meager -0.2 percent spells trouble for Switzerland.

The Absent decisive fiscal and monetary policy measures the economy may well sleepwalk into recession. Details» |

| |

2024-02-18 |

Quantification |

Forecast update. The «KOF Surprise Indicator» laying low again at -0.04 (slightly up from -0.051, revised) proving the case of

proving the case of dire roads for Swiss GDP. The annual growth rate of only 0.5 percent shows that Switzerland so far has only narrowly escaped recession.

The apparent lack of coordinated fiscal and monetary policy may eventually push the economy over the brink. Details» |

| |

2023-12-14 |

Competition policy

|

DIY cartel buster. Systematic data analysis enables cartels to be identified at an early stage. Clever statistical procedures enable

awarding authorities and corporate builders to protect themselves efficiently and effectively against damage caused by agreements: «DIY digital cartel detection»

now available for everyone. Start now» |

| |

2023-11-14 |

Quantification |

Forecast update. The «KOF Surprise Indicator» in shatters at -0.05 (down from -0.021, revised) strongly indicating that Swiss GDP growth effectively has come to a standstill with

an estimates 0.1 percent year-on-year expansion in the third quarter. Co-ordinated fiscal and monetary policy are now the last line of defense against a full-fledged recession. Details» |

| |

2023-11-14 |

Competition policy

|

Cartel buster. Taking cartel busting to a new level with «AI powered» digital cartel detection now available for everyone (with chatGPT premium account). Innovative statistical indicators powered by AI stop cartels before they can do harm. Watch how» |

| |

2023-09-02 |

Quantification |

Forecast update. A minor uptick to -0.022 (up from -0.03, revised) of the «KOF Surprise Indicator» has Swiss GDP expansion again at 1.4 percent year-on-year. Read also why Sargent's «fiscal theory of the price level» is largely flawed due to his mis-reading of key historical facts. Details» |

| |

2023-08-08 |

Financial markets

|

1923 hyperinflations. The 1923 hyperinflations in central Europe do not support Sargent's «Fiscal theory of the price level». Read why» |

| |

2022-12-16 |

Financial markets

|

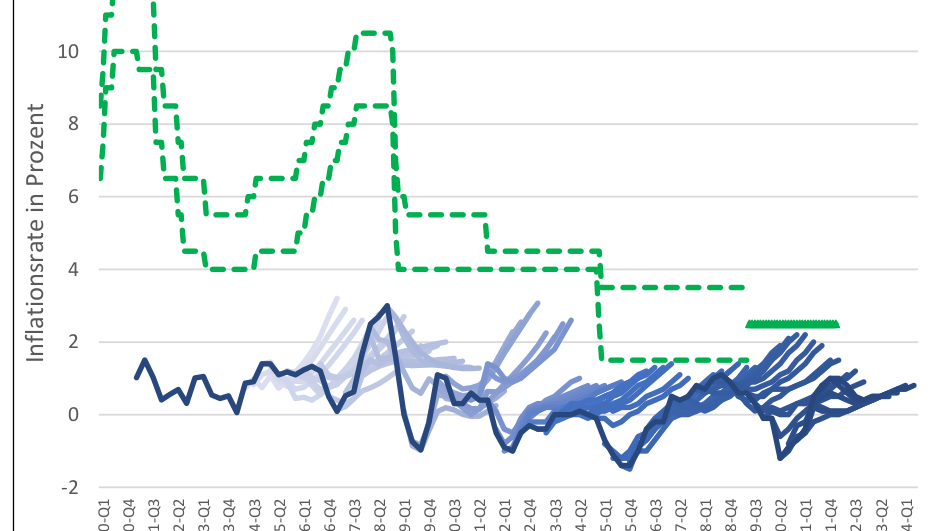

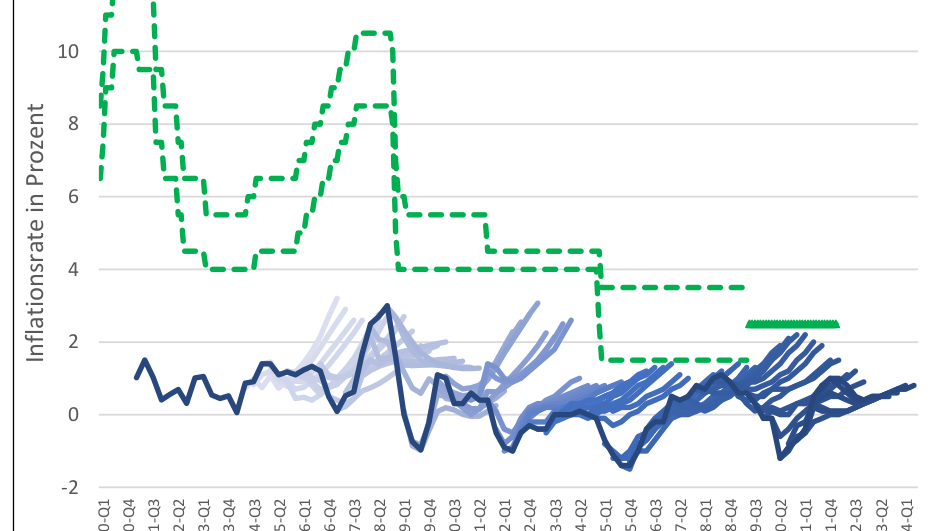

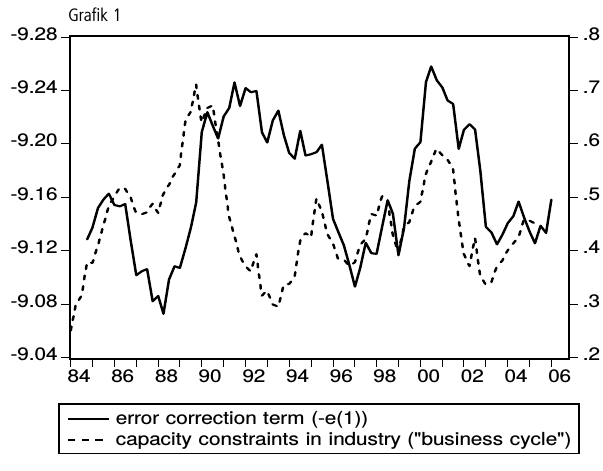

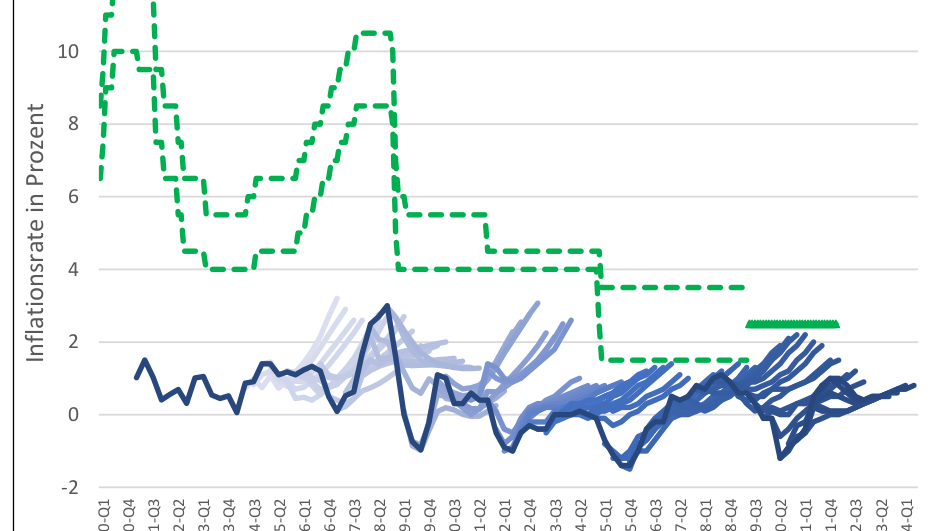

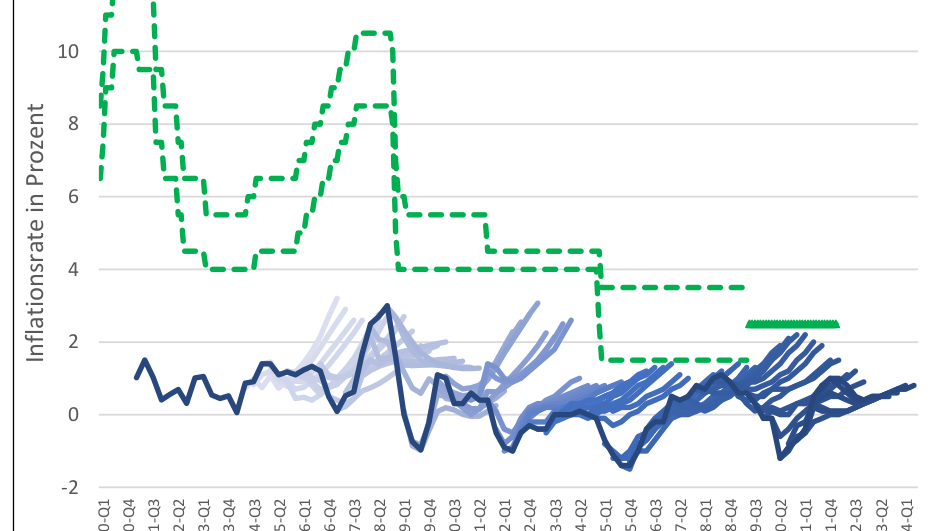

Swiss National Bank UPDATE. The Swiss National Bank has managed to keep inflation in check ever since the introduction of its new strategy at the turn of the century. Strikingly, the new strategy has never been fully applied and its elements completely disintegrated following the great financial crisis. How comes that the SNB nonetheless is successful in keeping inflation at bay? Details» (in German) |

| |

2022-11-16 |

|

Forecast update. Against many odds the «KOF Surprise Indicator» recovers to -0.009 indicating that Swiss value added logs 3.5 percent growth year-on-year in 2022, third quarter. Details» |

| |

2022-09-10 |

Various

|

Diversity & inclusion. Why and how companies can benefit from a diversity and inclusion strategy? First answers. Details» (in German) |

| |

2022-08-17 |

|

Forecast update. Fulfilling earlier expectations the «KOF Surprise Indicator» slips to -0.026 signalling a muted yet still respectable 2.1 percent Swiss GDP expansion year-on-year in the second quarter of 2022. Details» |

| |

2022-06-14 |

Financial markets

|

Swiss National Bank. The Swiss National Bank has managed to keep inflation in check ever since the introduction of its new strategy at the turn of the century. Strikingly, the new strategy has never been fully applied and its elements completely disintegrated following the great financial crisis. How comes that the SNB nonetheless is successful in keeping inflation at bay? Details» (in German) |

| |

2022-05-25 |

|

Forecast update. Further climbing to now -0.011 (up from -0.012, revised) the «KOF Surprise Indicator» marks yet another strong Swiss GDP expansion to the tune of 5.1 percent year-on-year in the first quarter of 2022.With special feature «2022 Clark medal celebration». Details» |

| |

2022-05-05 |

Fiscal Policy

|

Swiss farms. This new set of indicators describes the economic situation of Swiss farms in as yet unseen detail and comprehensiveness. Some economic theory advises on how to best use these indicators for agrigultural policy conduct. Details» |

| |

2022-05-02 |

|

Macrofinance.The American Economic Association has now officially acknowledged that foreign exchange rates should be regarded independent of other macro variables in macroeconomic models as this assumption helps resolving a great many «puzzles». This move has the potential to mark an important milestone towards a new, human-centred economics. At the same time it confirms the findings and arguments put forward on these pages during the past decade. Details» |

| |

2022-02-02 |

|

Empirical macroeconomics makes a strong claim to policy even arguing that its «microfounded» approach informs policy makers about the effects of policy shifts. This 2022 ASSA meeting expert survey shows, however, that the very «microfoundations» deliberately lack empirical support leading to completely arbitrary, uninformative results. Details» |

| |

2021-11-17 |

Quantification |

Forecast update. The «KOF Surprise Indicator» drops to -0.023 (down from -0.018) in 2021, 3rd quarter implying a still impressive Swiss GDP growth to the tune of 2.85 percent year-on-year. Read also why the resurrection of the «Historical School» by means of «causal inference» story telling has its downsides. Details» |

| |

2021-11-17 |

|

Monopolies may benefit the environment if they reduce greenhouse gas emission by excessive prices. If they hinder the adoption of environmentally friendly technology they demand very close scrutiny. The city of Schaffhausen is a case in point. By establishing a monopoly for warmth/cold networks the spread of this ecologically benefitial technology could be jeopardised, our new study finds. Details» |

| |

2021-08-30 |

Quantification |

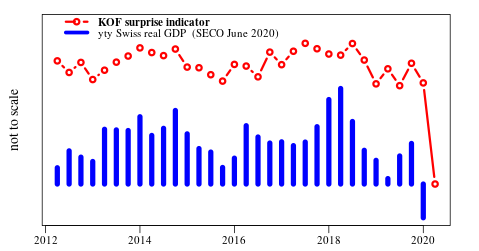

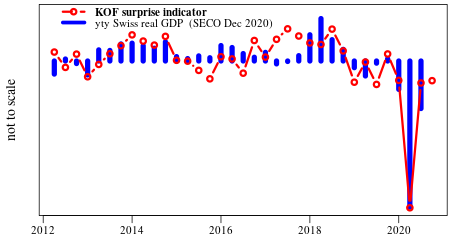

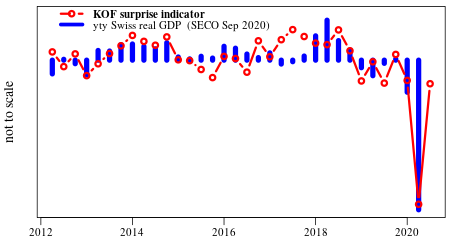

Forecast update. Riding the wave of the «KOF Surprise Indicator» surge to -0.018 (up from a revised -0.051) Swiss GDP growth amounts to 5.05 percent year-on-year in 2021, 2nd quarter. Plus, latest official estimates for 2020 once again demonstrate the superiority of the surprise indicator method. Details» |

| |

2021-06-05 |

|

Causal inference by pretending to predict the very facts that lie before them in the brightest daylight is what Hochmuth and others offer in a recent Journal of Economic Dynamics & Control article. Unfortunately, since nothing is easier than predicting the past, the whole math whizz of their elaborate and ingenious «DSGE» model is a (pretty) pointless exercise. Details» |

| |

2021-05-14 |

Quantification |

Forecast update. Switzerland's way out of Corona-induced recession continues with the latest reading of the «KOF Surprise Indicator» steadying at -0.056. Despite a slight drop from -0.047 estimated GDP growth amounts to -0.57 percent year-on-year in 2021, 1st quarter. Details» |

| |

2021-02-24 |

|

Forecast update. The Corona pandemic devastated Swiss GDP in 2020 yet the annual result looks quite bearable at -2.5 percent over the whole year, the «KOF Surprise Indicator» implies. The indicator improves slightly to -0.046 (up from -0.048 in 2020q3) suggesting a much year-on-year growth of about -0.5 percent in Q4, 2020. Details» |

| |

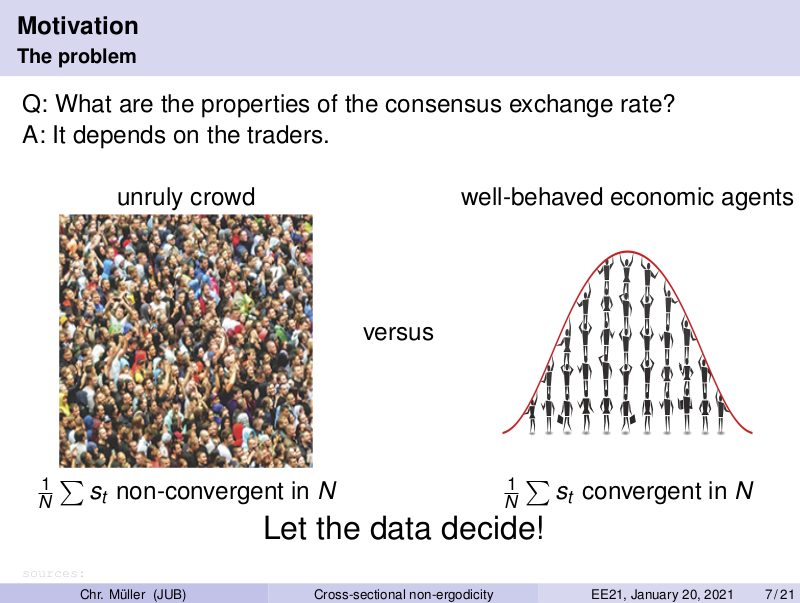

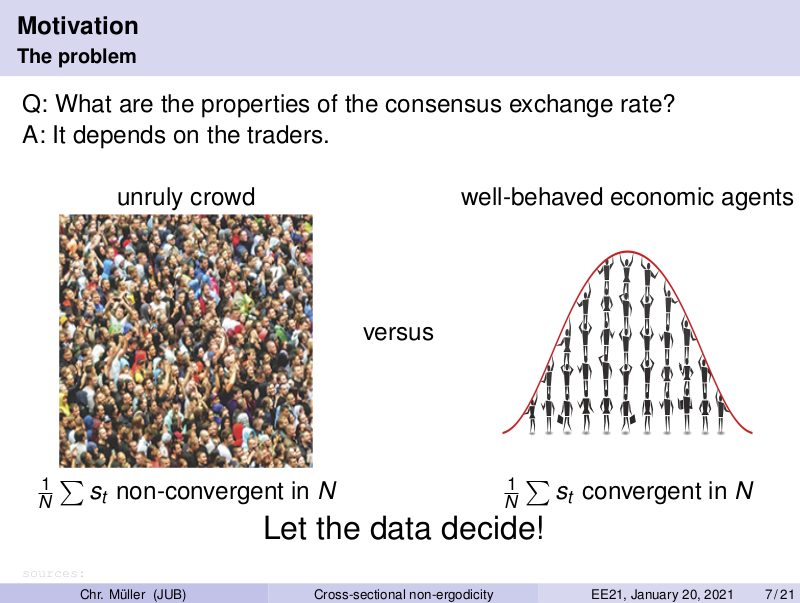

2021-01-20 |

Financial markets  |

Presentation. Asset prices are ruled by individuals not probability laws. Watch and listen to the evidence for non-ergodicity of trader samples. Details» |

| |

2020-11-13 |

|

Forecast update. Swiss GDP bounces back very strongly in the 3rd quarter, the «KOF Surprise Indicator» tells. Owed to the significant slowdown in Covid spreading the indicator recovers to -0.049 (up from -0.13 in 2020q2) implying a much better year-on-year growth of about -3.8 percent in Q3, 2020. Details» |

| |

2020-10-01 |

Financial markets  |

Comment. Modern macro models suffer from an inherent contradiction: agents optimise over an infinite horizon while readers are made to believe that model updates are coming soon, sooner than infinity. Gabaix (AER, 2020) is a point in case. Details» |

| |

2020-09-28 |

|

How to fix the «missing elite» problem in east Germany? Genuine east German elites are missing at large. Top positions in east and west Germany are overwhelmingly occupied by west Germans with devastating effects on the east German society threatening democracy. Though a simple, well-established solution exists (in German) Details» |

| |

2020-08-20 |

Quantification |

Forecast update. In contrast to early expectations and to its neighbours Switzerland seems to sail rather comfortably through the corona crisis, the latest reading of the «KOF Surprise Indicator» suggests. GDP growth still takes a hit to the tune of -5.1 percent year-on-year in 2020, 2nd quarter. Details» |

| |

2020-06-16 |

|

What shall we do with the «Corona» deficit?. A negative poll tax is part of the answer! (in German) Details» |

| |

2020-05-14 |

Quantification |

Forecast update. Just before COVID-19 hit the «KOF Surprise Indicator» slips again to -0.04 (2019 Q4: -0.02) logging moderate 0.8 percent growth year-on-year in the first quarter, 2020. The new estimate benefits from the usual upward revision of SECO guesses in SECO's March release. Details» |

| |

2020-04-13 |

|

What is money (hoisted from the archive). Whether it is money decides the receiver who has to trust that the money (s)he accepts will buy him / her at least as much utility as (s)he gives up in exchange for money. Consequently, money is equivalent to the trust in those institutions that guarantee the future exchange without loss. This (new) money defintion better suites reality than common functionality based ones. (in German). Details» |

| |

2015-01-28 |

Fiscal policy

|

Note on the SNB's lift of the fx floor (hoisted from the archive). The SNB lifted the floor on the Swiss Franc - Euro rate earlier this (2015) year. This move yields several lessons with respect to the future conduct of monetary policy. Most importantly of all, the SNB's word will not regain the weight it used to have (in German). Details» |

| |

2020-04-13 |

|

Fighting Corona. The famed Swiss debt brake knows a lesser known amendmend that may turn the Swiss Government's fiscal anti crisis bazooka against the Swiss economy. It is not difficult to attend to this threat but it requires some bold moves by the government and parliament. Details» |

| |

2020-03-26 |

Fiscal policy

|

Federal budget in Switzerland. Public opinion in Switzerland has it that repeated surpluses in the Federal budget are the results of considerate and modest budgeting in line with the famed Swiss debt brake. The truth is more prosaic. The lion's share of surpluses is owed to systematic business cycle forecasting errors. (in German). Details» |

| |

2020-02-19 |

|

Forecast update. Swiss GDP gains 0.8 percent in 2019 the «KOF Surprise Indicator» tells. Its latest reading of -0.02 (up from -0.05 in 2019q4) shows that growth picks up slightly to about 1.4 percent year-on-year in the last quarter of 2019. Details» |

| |

2019-12-05 |

Fiscal policy

|

Fighting causes of migration. If you think you have o fight migration in spite of its economic benefits addressing the root causes of migration might be the way to go. However, German unification tells you that even under ideal circumstances this fight might be a lost cause (pp. 7-11, in German). Details» |

| |

2019-11-15 |

|

Forecast update. The «KOF Surprise Indicator» again tests recession territory at -0.05 (2019 Q2: -0.03) after its brief recovery in summer. This latest reading indicates that annual growth remains weak at about 1.2 percent year-on-year expansion in the third quarter of 2019. Details» |

| |

2019-08-22 |

Fiscal policy

|

Swiss federal tax revenues. Following the introduction of the Swiss debt brake federal tax revenues established a habit of exceeding expectations. Mounting surpluses deny parliament its right to budget and question the legitiimacy of the debt brake rule. Mediocre GDP forecasts are partly to blame and fixes are well feasible (in German). Details» |

| |

2019-08-14 |

|

Forecast update. Weak growth of Swiss value added continues despite a slight uptick of the «KOF Surprise Indicator» to -0.03 (2019 Q1: -0.05). This latest reading indicates that annual growth remains below the one-percen mark year-on-year expansion estimated to amount to 0.84 percent in the second quarter of 2019. Details» |

| |

2019-05-16 |

Quantification  |

Forecast update. Swiss growth takes another hit as the May reading of the «KOF Surprise Indicator» logs -0.05 (2018 Q4: -0.03), a level last seen in late 2009. This drop indicates that annual growth has stalled with year-on-year expansion now in negative territory at -0.2 percent in the first quarter of 2019. Details» |

| |

2019-02-26 |

|

Forecast update. The «KOF

Surprise Indicator» for measuring Swiss economic

activity crashes to -0.030 (down from -0.014), its lowest value

in two years. Swiss GDP growth is estimated at

a weak 1.9 percent year-on-year implying a

nonetheless impressive annual 3.1 percent expansion in 2018. Details» |

| |

2019-02-05 |

|

What's knowledge in economics? In contrast to science that offers the prospect of clear-cut

answers to precise questions, economists very often give ambigious

if not outright contradictory advice. What may look like as a

severe drawback should be embraced as a key and rewarding

challenge, this brief note argues (in German). Details» |

| |

2019-01-18 |

Financial markets

|

Published. My new book «Uncertainty and Economics» to be published 24th of January 2019! Read in this exclusive

preview why uncertainty must be considered as the basis of

economic theorising and why - against popular economic belief -

emotions, therefore, play a key role in economic decision making. Details» |

| |

2018-12-03 |

|

Lucas critique. Is it rational to apply

rational expectations models to economic problems? The Lucas

(1976) critique clearly tells that it isn't. Uncertainty offers a

reconciliation. Details» |

| |

2018-11-14 |

Quantification |

Forecast update. The «KOF

Surprise Indicator» for measuring Swiss economic

dynamics flags a healthy expansion of Swiss value added. Its

latest reading of -0.014 (up from a revised -0.021) comes close

its last high recorded one year ago. The nowcast of Swiss

GDP puts Swiss year-on-year growth at 3.5

percent in the third quarter 2018. Details» |

| |

2018-09-18 |

|

Economic development. Germany makes headlines owed to outbreaks of violence against

foreigners. Some think that this violence is the result of an East

German echo chamber within which xenophobic sentiments blossom.

This novel analysis shows that the German press contributes to a

new East-West divide putting the unification process on hold (in

German). Details» |

| |

2018-08-15 |

Quantification |

Forecast update. The

Swiss Economy maintains its momentum at large, the latest

reading of the «KOF surprise indicator» shows.

Despite a drop of the KOF surprise indicator from its latest

high to -0.023 (down from a revised -0.019), the nowcast of Swiss

GDP growth indicates that Swiss year-on-year growth

remains strong at 2.4 percent in the second

quarter 2018. Details» |

| |

2018-06-05 |

|

Monetary reform. The «sovereign

money» proposal in Switzerland stirs considerable

discussion. Sometimes it turns paradoxial when opponents switch

sides without even being aware (in German). Details» |

| |

2018-05-25 |

Quantification |

Forecast update. No

surprises from the «KOF surprise indicator» for measuring Swiss economic dynamics as it stays put at -0.021 (slightly down from -0.020) in 2018,

first quarter. This signal of strength combined with slight

upward revisions of recent GDP data boosts the nowcast for the

Swiss economy. Details» |

| |

2018-04-11 |

Fiscal policy  |

Debt brakes. Do debt

brakes need the «right» design for working

properly? No, recent results obtained with a new methodology show.

The standard methods in the literature are badly flawed which is

why some results may really surprise you. Details» |

| |

ARCHIVE |

|

|

| |

« back |

|

|